Introduction

The UK operates a mature contractor & freelance economy across finance and legal, supported by deep talent supply and a large Alternative Legal Services Provider (ALSP) market. Luxembourg shows lower self-employment penetration but strong finance demand and rising entrepreneurship, implying headroom for independent consultants in compliance, data, legal support, and change. Evidence from official datasets and market studies confirms this gap and the opportunity.

Market Penetration and Momentum

United Kingdom. Contractor usage is widespread across financial services, with official ONS datasets providing quarterly counts of employees vs. self-employed by industry (EMP14). These are the reference series for sizing contractor penetration in “Financial and insurance activities.”

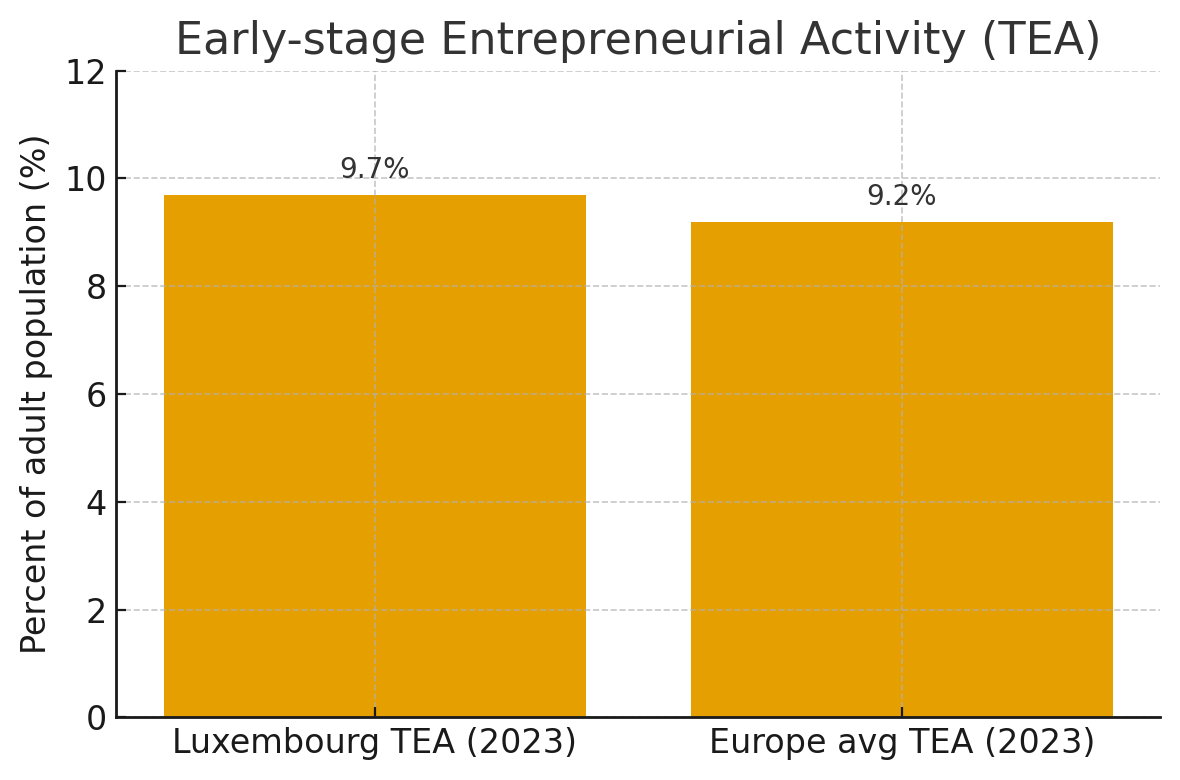

Luxembourg. Independent workers accounted for ~10% of the workforce in 2023 (World Bank data cited by Luxembourg Times), indicating a smaller base of freelancers relative to total employment. At the same time, Luxembourg’s early-stage entrepreneurship rate (TEA = Percentage of 18-64 population who are either a nascent entrepreneur or owner-manager of a new business) reached 9.7% in 2023, slightly above the European average of 9.2%, showing healthy entrepreneurial intent that can feed the freelance pool.

Graph above: Early-stage Entrepreneurial Activity (TEA), Luxembourg vs Europe (2023). Source: GEM Luxembourg 2023/24, STATEC. Values cited in the executive summary of the report (Luxembourg TEA 9.7% vs Europe 9.2%).

Services Independent Consultants Deliver

Banks, asset managers, and servicers in the UK and Luxembourg hire independents for high-skill tasks that don’t transfer regulated accountability. Typical lines include:

- Regulatory change: policy updates, impact/gap analysis, operating model changes, documentation, and project execution.

- AML/KYC remediation: backlog clearance, data clean-ups, client outreach, file refresh; legal-ops style document review.

- Data and reporting automation: extracting, transforming, and validating data for regulatory and management reporting.

- Legal operations and contract management: playbooks, CLM workflows, repapering, and regulatory change documentation.

- Project and change management: TOM design, platform migrations, and cross-border implementation programs.

| Service Line | UK Market Signal | Luxembourg Signal | Indicative Sources |

| Regulatory change support (policies, gap analysis, implementation) | Strong ALSP and independent consultant usage in banks and legal operations | High demand in finance; boutique and independent consultants frequently used | Thomson Reuters ALSP 2025 report; STATEC sector data |

| AML/KYC remediation & client data cleanup | Frequent contract staffing; e-discovery and document review at scale | Recurring remediation waves; project-based teams | Reuters ALSP 2025 coverage; LFF/Deloitte sector studies |

| Data engineering & reporting automation (MiFID/EMIR/SFTR) | High contractor penetration via platforms and interim specialists | Growing demand under DORA and reporting digitalisation | ONS contractor ecosystem; CSSF context |

| Legal operations & contract lifecycle support | Large ALSP footprint serving financial institutions | Used on demand by banks and asset servicers | Thomson Reuters ALSP 2025 |

| Project & change management (TOM, systems migrations) | Mature contractor market across FS change portfolios | Ongoing demand in ManCos, banks, asset servicers | Hays & Robert Walters 2025 guides; STATEC data |

Table above: Freelance service lines — UK vs Luxembourg. The table maps service lines to ecosystem signals, with sources including Thomson Reuters’ ALSP reporting and Luxembourg sector publications.

Rates, Flexibility, and Engagement Models

Rates. Public, role-specific day-rate datasets vary. UK recruiter salary guides and contractor reports (e.g., Hays, Robert Walters) provide indicative ranges used by FS buyers and consultants; they confirm persistent demand for interim specialists in data, change, and legal-ops. We avoid quoting figures that shift by role/sector and lack harmonized official series; use the referenced guides when pricing individual mandates.

Flexibility.

- UK: Engagement models are shaped by market practice and tax classification rules; the ONS EMP14 framework shows sustained use of self-employed talent alongside employees across industries, including finance.

- Luxembourg: Entrepreneurship indicators from the Global Entrepreneurship Monitor (GEM) show intent and activity recovering to pre-pandemic levels. This suggests a growing pool of independent specialists who can staff compliance, data, and legal-ops projects on demand.

Ecosystem Comparison and Growth Potential

- UK maturity: Deep bench of contractors and ALSPs, standardized playbooks for onboarding and delivery in banks and legal departments, and ready access to role-based market data.

- Luxembourg runway: Smaller freelance base today but strong finance footprint, high wages, and cross-border talent inflows. TEA above the European average underscores growth potential for independents if buyers streamline sourcing and onboarding through curated marketplaces.

Practical Playbook for Luxembourg Buyers and freelance Consultants

For Corporate Buyers and Financial Institutions

- Clarify where freelancers add value. Independent consultants are most effective in project-based assignments — regulatory change, reporting automation, AML/KYC remediation, or operating-model design — that complement but don’t replace regulated functions.

- Standardize engagement models. Define contract templates, onboarding steps, confidentiality clauses, and deliverable formats compatible with your internal governance and CSSF outsourcing principles.

- Benchmark rates and timelines. Use public sources and local data to ensure fair, market-based pricing and realistic project durations.

- Track performance and compliance. Apply the same KPIs used for internal teams — milestones, documentation quality, regulatory accuracy — to independent consultants.

For Independent Consultants

- Specialize and signal credibility. Focus on defined expertise areas (MiFID II, DORA, AML/KYC, fund operations) and highlight proven outcomes rather than generic skills.

- Build digital visibility. Maintain complete profiles on professional marketplaces and LinkedIn, with headline summaries, validated projects, and references.

- Invest in tools and certification. Competence in data analytics, RegTech platforms, or project-management frameworks (e.g., PRINCE2, Agile) increases marketability.

- Leverage community and peer learning. Participate in networks of independent professionals to share leads, rate benchmarks, and best practices.

Connecting Both Sides

Platforms such as We Put You in Touch simplify this interaction:

- Buyers gain a vetted pool of consultants, transparent pricing, and digital contracting.

- Consultants access targeted engagements without the overhead of traditional intermediaries.

By formalizing engagement standards and widening access to qualified independents, Luxembourg’s financial sector can replicate the UK’s flexibility while preserving regulatory rigor and service quality.

References

- ONS — Dataset EMP14: Employees and self-employed by industry (UK), latest edition August 12, 2025.

- STATEC — Global Entrepreneurship Monitor Luxembourg 2023/24 (TEA 9.7% vs EU 9.2%).

- Luxembourg Times — Coverage citing World Bank on independent workers’ share of Luxembourg’s workforce (~10% in 2023).

- Thomson Reuters — ALSP market report 2025 (market size and UK corporate legal adoption).